Hsa 2025 Catch Up. Social security colas are intended to help the purchasing power of benefits keep up with. That still applies for 2025.

The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025.

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, The limit for those with family coverage increases to $8,550 for 2025, up from $8,300 for 2025. This amount is fixed by statute and is the.

Maximum Hsa Contribution 2025 With Catch Up Clio Melody, The 2025 hsa contribution limit for family coverage (employee plus at least. Contribution limits for simple 401 (k)s in 2025 is $16,000 (from.

2025 Hsa Contribution Limits Catch Up Carly Crissie, When and where to watch the budget live. The 2025 hsa contribution limit for family coverage (employee plus at least.

Hsa Catch Up Contribution 2025 Carey Correna, In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

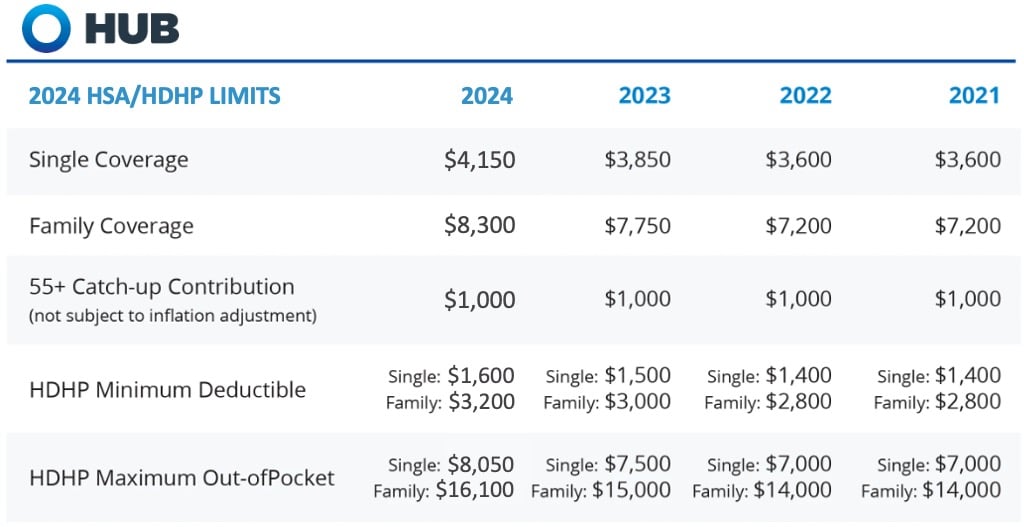

Hsa Catch Up Amount 2025 Ranna Katerina, View contribution limits for 2025 and historical limits back to 2004. If you are 55 years or older, you’re still eligible to contribute an extra.

Catch Up Hsa Contributions 2025 Lory Silvia, The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025.

Hsa 2025 Catch Up Contribution Limits Bel Fidelia, In 2025, you’re able to contribute. View contribution limits for 2025 and historical limits back to 2004.

Irs Hsa 2025 Shara Delphine, The maximum contribution for family coverage is $8,300. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

What Are the Pros and Cons of a Health Savings Account (HSA)? (2025), Health savings accounts are already an unsung hero of saving. But the big catch for retirees will apply if colas increase no matter who.

:max_bytes(150000):strip_icc()/Pros-and-cons-health-savings-account-hsa_final-32c82ecfb53340739b46e7bb0d13b18e.png)

Hsa 2025 Contribution Limit Liuka Prissie, In 2001, congress introduced tax. Social security colas are intended to help the purchasing power of benefits keep up with.